by Dr Daby POUYE, PhD in finance

We do not win a war with the soldiers of others. It is primarily to African investors and entrepreneurs to build African financial reputation. And it is up to African states to put in place concrete measures to efficiently support this participation of African financial actors. Words and deeds are what we need to help our financial reputation.

The establishment of the ZLEC (Continental Free Trade Area) whose agreement was signed March 21, 2018 by 44 African countries (an estimated area of $ 3 trillion in production and 1.2 billion individuals ) in Kigali, through the establishment of a genuine intra-community and inclusive industrial development strategy, will enable the emergence of locomotives capable of facing international competition. The process is started. This achievable challenge will have to be accompanied by the consolidation of the financial reputation of African markets, as a condition for strengthening the recognition of African financial expertise.

The reinforcement of intra-zone physical flows should also be accompanied, all other things being equal, by an increase in financial flows and therefore, in fine, an acceleration and a quantitative and qualitative improvement in intra-EU foreign direct investment. It is a question of relying on the private sector in a PPP approach including on the one hand the support of the African States (especially in terms of providing the necessary guarantee for the private sector, particularly through the DFIs1). substantial participation of the private sector in particular in infrastructure projects and at the same time acquire financial centers and therefore local institutional investors able to financially and efficiently support the movement.

The existence of African financial centers is a condition sine qua non for real economic independence and an indispensable control of our economic policy. And among the determinants of a financial center is reputation. It is therefore necessary to begin the deconstruction2 of Africa’s financial reputation.

We need to deconstruct the current image of Africa and build on financial successes to reinforce the image of African financial expertise in construction. After a perimeter of a polysemic notion, we will begin by describing the current image to be deconstructed before finishing on the elements that we think are important to develop to assert the image the financial expertise of Africa. Deconstruct to rebuild, deconstruct and rebuild.

It is Affirming and Showing African Expertise as a Vector of the Reputation of African Financial Places: the stakes are high.

Reputation: a polysemic concept.

The role of reputation in forming the credibility of a financial center is indisputable. Indeed, as attested in particular by its integration into the criteria for ranking financial markets by GFCI3, reputation is a variable to be taken into account for any financial center wishing to develop an international positioning strategy.

But before analyzing its impact and the urgency for Africa of its deconstruction in the perspective of strengthening its credibility, it is first necessary to define the contours of a polysemic notion that is difficult to perimeter. In management sciences, reputation is seen as an intangible resource with a significant impact on performance.

If at academic level, there is no consensus on the definition of this notion, we can nevertheless start from the definition of Fombrun (1996) to focus on the elements that will serve us as a guideline in our development. Indeed, the latter defines the reputation as “a perceptual representation of a company’s past actions and future prospects that describes the firm’s overall appeal to all of its key constituents when compared with other leading rivals”.

This definition calls for the following remarks: on the one hand, reputation is the fruit of perception; on the other hand, in its dimension of social identity, reputation is the result of the sum of the perceptions of all stakholders; and it’s finally a ranking criterion. Whichever angle is chosen, there is a consensus that there is a positive correlation between reputation and credibility.

The image of Africa and its impact on the reputation of African financial centers.

The reputation of Africa and its financial centers are inseparable. This reputation must be apprehended both globally and individually. And undoubtedly, as far as this dimension is concerned, Africa is lagging far behind. Indeed, the importance of communication has been greatly neglected. Both inside and outside, the terms describing Africa’s reputation have always been and still are unflattering.

– Regarding the question of perception, today the actors who make and break the image are mainly located in the European financial markets and do not voluntarily ignore (which reinforces the dominant position of the Western financial centers and the benefits that go with it) or unintentionally (which requires communication work to explain African financial expertise) of Africa. What about this picture?

Regarding the collective dimension, we have on the one hand the Western media accustomed to “sensationalism” and always ready to focus on the various facts that are there to diversion by obscuring the African advances in financial engineering and development. On the other hand, the Africans who reinforce this image by systematically investing in the West, aided, must be said by the absence of investor protection measures within our States.

The newspaper articles preceding the positive changes in the position of the African financial markets in the rankings operated by the various rating services (notably the GFCI) of the attractiveness of the financial markets emphasize the “feat” achieved by these companies. latest. As if through this “over-mediaization”, we wanted to show the “abnormal” character of the new position taken by this or that African financial center. So it is an implicit way of saying that there is the “court of the great who, from time to time accepts some lost sheep”. This is the importance of words and their impact in the conscious and the subconscious.

The combination of this set makes it possible to say that today Africa is perceived as an “underdeveloped” (or developing or still developing) continent compared to so-called developed countries.

This perception is reinforced by the media hype in which the expressions associated with Africa are systematically “mismanagement”, “lack of maturity”, “lack of expertise”.

As a result, the various African financial institutions have always been considered to be “accompanied, assisted, supported” by “international experts” who knew better than they “suffered”. As a result, private African financial organizations and regulatory institutions are struggling to establish themselves internationally as credible structures.

The establishment of attractive financial markets will therefore pass through the “dice” construction of the reputation of Africa: deconstruct and rebuild because the reputation is an individual and collective social construct that involves on the one hand the perception that Africans have on their continent and on the other hand the image that Africa sends back to the world.

The first point can be summarized in a pithy phrase: “Africans believe in Africa, love Africa but … do not trust it”. Regarding the second aspect, the image of Africa is narrated in unflattering terms. On the managerial level, Africa is described as a continent characterized by mismanagement and economic, social and legal instability. This image, distilled for decades, creates, on the outside, negative cognitive and emotional perceptions about Africa.

A financial reputation to build via an African inking leverage of a winning opening.

The African financial reputation is under construction and on track. On the one hand, it is important to focus on current successes and, on the other hand, to set the conditions for its reinforcement.

• Initially, we must rely on the emergence of real financial hubs today in Africa. Undeniably, we are witnessing the strengthening of the reputation of certain places considered more and more as true financial hubs. In the 2017 rankings of GFCI’s 96 most competitive financial markets, we find the City of Casablanca, the leading African financial center at 32nd place ahead of Johannesburg, 52nd and Maurice 56th. This allows Said Ibrahimi, General Manager of Casablanca Finance City Authority (CFCA), to consider the integration of CFCA into the top 40 of the world ranking of financial centers incontestably as a factor to improve the reputation of the Moroccan financial center and strengthening its credibility as a global financial center.

Also, in a strategic and concerted way, we need to consolidate some financial centers and make them hubs capable of competing with the largest international financial centers. This is for example West Africa from Nigeria and Morocco, South Africa for the Southern Region and finally Kenya for the East Africa Zone. And secondly, choose a target country in each zone so as to make it a spoke and thus obtain an efficient financial mesh capable of supporting African growth.

• Another way to boost reputation is through the development of intra-EU trade. To push open doors, it is useful to recall this evidence: “we do not win a war with the soldiers of others”. Several avenues to promote the strengthening of our local economic and financial roots to better face international competition. Today, capital flows that support some of the highest economic growth in Africa attest to good prospects for development. Overall, the measures put in place in some African states favor a reduction of the weight of the foreign constraint in the indebtedness of our nations. The example of Morocco deserves to be underlined. Indeed, for twenty years, Morocco has opted to strengthen the domestic share of its debt to the detriment of the share granted abroad. Suddenly this new deal serves the vice that represents the weight of foreign investors in the economic guidelines of the Kingdom. An example to benchmark.

• The first urgency to strengthen the reputation of African financial markets is therefore to devote the bulk of our efforts to putting in place measures to attract and sustainably retain African investors from the interior and the diaspora. How? We must set up a real financial cluster for African companies and strengthen the right of African investors by attractive tax measures and greater protection of their investment and why not, safeguard anonymity that is not necessarily synonymous with laundering. The reforms of our institutions must go in this direction.

• The 2000s undeniably prove that Africa has become an attractive and credible area for investors. Indeed, in 2005, the sale of celtel4 for nearly 3.5 billion US dollars marks the interest of private equity in Africa. Since then, the increasing increase in the amounts mobilized by different investment funds in the sale and investment transactions constitutes proof that performance, financial, social and societal economic performance indicators are increasing significantly. We must therefore not only focus on these successes but also and above all support them by setting up an extension strategy through financial media capable of relaying the right financial information.

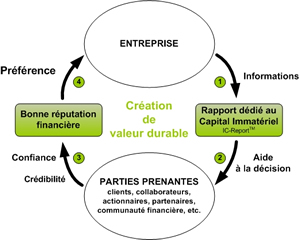

To summarize, it must be emphasized that reputation is a social process built in an exchange network. Stakeholder confidence in the ranks

of which a special place should be given to African investors, is a means of reinforcing this reputation.

Reputation will therefore pass through trust in the African financial system. The first locomotive actors of this trust are and will be the Africans themselves.

Conclusion:

Deconstruction and building the reputation of African financial markets is a factor in the emergence and densification of African investment funds essential to support African growth and can attract African investors for the long term (from the inside out outside) and foreigners. The result of an internal and external perception of Africa and the quality of its expertise, the reputation of the African financial centers is both individual and collective. It’s a big issue and it’s in the hands of Africans.

Dr. Daby POUYE.

PhD in Management Sciences Prospective Specialty, Innovation, Strategy, Organization.

The notes

1-Development financial institutions can serve as a guarantee for the granting of funds to African structures carrying viable projects but “unrecognized” by the traditional financing system.

2 -This is to deconstruct the current image to build the image of a financial Africa on the move.

3-The Global Financial Center Index is an index produced by London’s Think Tank Y / Zen. It is a reference in terms of ranking the world’s financial centers in terms of competitiveness. The index takes into account data on the economic environment of the financial center, the level of development of its financial sector, available human capital, infrastructures and finally the reputation and on the other hand, the opinion 3500 financial services professionals.

4-Celtel is a mobile operator created in 1998 by Mo Ibrahim, a very wealthy Sudanese businessman.