The African Export-Import Bank (Afreximbank) vaulted market uncertainties caused by COVID-19 pandemic to successfully conclude a dual-currency Syndicated Loan, raising the equivalent of US$907.5 million, comprised of two tranches of US$485 million and EUR390.4 million.

Proceeds will be used for general corporate activities, and will strengthen the Bank’s liquidity position as it implements its US$3 billion Pandemic Trade Impact Mitigation Facility (PATIMFA).

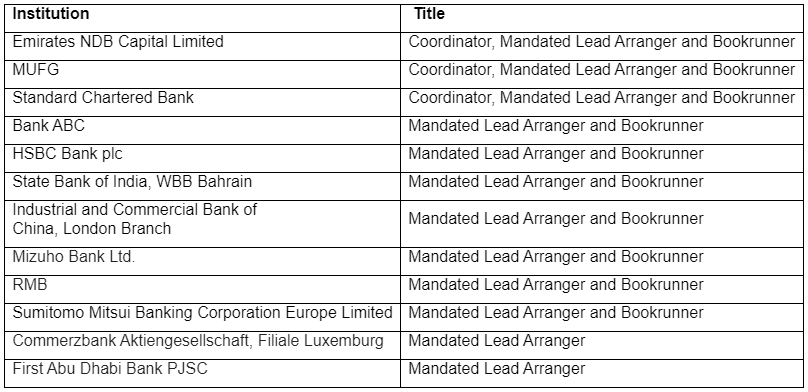

Emirates NBD Capital Limited, MUFG Bank Ltd and Standard Chartered Bank acted as joint Global Coordinators, Initial Mandated Lead Arrangers and Bookrunners for the Facility. MUFG Bank Ltd also acted as Documentation Agent and Standard Chartered Bank as Facility Agent.

Launched on 9 April 2020 to a limited group of relationship banks at an amount of US$600 million equivalent, the facility was more than 50% oversubscribed allowing its increase to US$1.1 billion equivalent with an accordion feature.

Afreximbank President Prof. Benedict Oramah said that the market’s confidence in the Bank, despite the COVID-19 pandemic-induced volatility and uncertainty was a testament to the strength of Afreximbank’s investor relationships.

“The final deal size and the relatively short period over which the funding was raised reflect the high regard and confidence the market has in Afreximbank’s financial strength and its importance to the continent,” he said.

“Afreximbank intends, in due course, to issue additional syndicated loans. The Bank looks forward to the continued support of the loan market at that time,” he added.

Syndicated Facility Lenders:

About Afreximbank: The African Export-Import Bank (Afreximbank) is a Pan-African multilateral financial institution with the mandate of financing and promoting intra-and extra-African trade. Afreximbank was established in October 1993 and owned by African governments, the African Development Bank and other African multilateral financial institutions as well as African and non-African public and private investors. The Bank was established under two constitutive documents, an Agreement signed by member states, which confers on the Bank the status of an international organization, and a Charter signed by all Shareholders, which governs its corporate structure and operations. Afreximbank deploys innovative structures to deliver financing solutions that are supporting the transformation of the structure of Africa’s trade, accelerating industrialization and intra-regional trade, thereby sustaining economic expansion in Africa. At the end of 2019, the Bank’s total assets and guarantees stood at USD$15.5 billion and its shareholders funds amounted to US$2.8 billion. Voted “African Bank of the Year” in 2019, the Bank disbursed more than US$31billion between 2016 and 2019. Afreximbank has ratings assigned by GCR (international scale) (A-), Moody’s (Baa1) and Fitch (BBB-). The Bank is headquartered in Cairo, Egypt. For more information, visit: www.afreximbank.com

The contents of this e-mail and of any attachments are confidential and privileged and are intended for the attention and use solely of the addressee(s). The contents do not necessarily represent the official view(s) of the African Export-Import Bank (Afreximbank). In the event that you are not named as an addressee, please notify the sender immediately, permanently delete the e-mail and any attachments, and do not disclose, disseminate, store or circulate either in whole or partial the contents of this e-mail or any attachments. Afreximbank will not accept any liability whatsoever for any loss or damage by reason of viruses affecting this e-mail.